Latest Articles

-

How does my business qualify for a green loan? | Alston and Bird

Put the E in ESG. Continuing our dive into environmental, social and governance (ESG) finance, our financial group examines the what, why and how of green lending principles.

- What is a green loan?

- The 4 basic components

- Recent green loans in UK and Europe

Part 1 of our ESG series introduced ESG, examined its impact on structured finance markets, and examined the implications of the COVID-19 pandemic on ESG.What are green loans?

Following a profusion of sustainable finance and development initiatives, both internationally and nationally in 2018, as evidence of changing investor preferences and increased recognition that investments in well-governed entities that create a positive social and environmental impact are increasingly important, the Loan Market Association (LMA), Asia Pacific Loan Market Association and Loan Syndications and Trading Association (LSTA) have launched the ‘Principles of green loan(GLP), which were designed to provide environmental, social and governance (ESG) criteria for credit products.

Since the launch of BPL, in all structured finance markets, an increasing number of “green” loans have emerged. The BPL defines green loans as “any type of lending instrument made available exclusively to finance or refinance, in whole or in part, new and / or existing eligible green projects. … Green loans must be aligned with the four essential components of GLP ”.

In other words, Green Day Online are loans whose proceeds are used specifically for environmentally friendly or sustainable purposes – for example, building solar or wind farms or investing in new green technologies. The BPL also places a very strong expectation that green loans will require continuous reporting and monitoring to ensure that the loans are being used for their intended purposes throughout the life of the loan. It is important to note that a distinction should be made between green loans and sustainability loans (and the LMA / LSTA sustainability lending principles), which we will discuss in our next article. The classification of loans linked to sustainability does not depend on how the product is used – the key characteristic is rather that the pricing is linked to the performance of the borrower against predetermined sustainability criteria. How businesses can attract cash for green loans has become a task that will become increasingly important in a post-COVID-19 world where cash scarcity will determine the survival of some businesses.

As a growing number of lenders seek to offer better loan terms to borrowers who are able to show they are reducing their environmental impact, green loans are growing rapidly. And it looks like the coronavirus pandemic hasn’t stopped the surge in green lending.

Why should my business take out a green loan?

There are a number of advantages for borrowers and lenders to take out green loans. The BPL suggests the following non-exhaustive list:

- Positive impact on the environment, climate change mitigation and adaptation.

- Positive impact on reputation and credibility.

- Build stronger, value-based relationships with stakeholders.

- Access new markets, offer greater resilience to market disruptions caused by climate change and reduce risk in portfolios.

- Access a larger and more diverse pool of investors, especially those looking for ESG-focused investments.

- Achieve regulatory and political objectives and commitments.

- Increase the ability to attract and retain staff who view contributions to sustainable development as an important part of their personal and professional life.

How does my business qualify? The 4 basic components

In order to qualify for a green loan, your business will need to comply with the “4 basic components”.

1. Use of the product

The fundamental determinant of a green loan is the use of the loan proceeds for green projects (and other related and support expenses, including R&D), which should be appropriately described in financial documents and, where applicable, in marketing materials. Your green projects should provide clear environmental benefits, which will be assessed and, if possible, quantified, measured and reported.

2. Project evaluation and selection process

You will need to clearly communicate to your lenders:

- Your company’s environmental and sustainable development goals.

- How your business determines how its projects fit into the eligible categories.

- The associated eligibility criteria, including, where applicable, exclusion criteria or any other process applied to identify and manage potentially significant environmental risks associated with the proposed projects.

3. Product management

The proceeds of your green loan will need to be credited to a dedicated account or otherwise appropriately tracked to maintain transparency and promote the integrity of your green loan. If your green loan takes the form of one or more tranches of a loan facility, each green tranche should be clearly designated, with the proceeds of the green tranche credited to a separate account or appropriately tracked.

4. Reports

You will have to make and keep up-to-date and easily available information on the use of the product to be renewed annually until it is fully used, and if necessary thereafter in the event of significant developments. According to the BPL, “this should include a list of green projects to which the green loan proceeds have been allocated and a brief description of the projects and amounts allocated and their expected impact”. When confidentiality is an issue, information can only be provided to institutions participating in the loan. GLP recommends the use of qualitative performance indicators and, where possible, quantitative performance measures (e.g. energy capacity, power generation, reduced / avoided greenhouse gas emissions) and disclosure of the Key underlying methodology or assumptions used in the quantitative determination.

Avoid greenwashing!

Greenwashing, in the context of green loans, occurs when a borrower or project is supposed to have green credentials, but those credentials are bogus, over-excited, or misleading. Of course, this practice is strongly discouraged by all market players. Many lenders have sought to prevent borrowers from taking advantage of favorable terms on their green loans by introducing quantitative environmental measures. For example, ING requires that any green loan meets at least three of its five ESG objectives.

Charges of greenwashing can lead to litigation, undermine investor confidence and call into question the integrity of green loans. The GLP and the four building blocks are therefore written to provide a clear framework of the processes to be followed to maintain the integrity of green loans.

Recent developments in the UK and Europe

Bank of Scotland £ 30million green loan for Glasgow properties

In mid-May, Dunaskin Properties secured £ 30million in financing from the Bank of Scotland against 10 of its downtown properties, including Baltic Chambers, Central Chambers and Ingram House.

The financing package was set up as part of the Bank of Scotland’s Green Lending Initiative and consisted of a term loan and revolving credit facility which gave Dunaskin the flexibility to trade assets and fund capital expenditures across the portfolio.

The green loan was part of the refinancing discussions and the broader plans for a clear sustainability strategy for Dunaskin. The terms of the deal include green commitments requiring the company to spend £ 1.2million on improving the sustainability of its buildings and meeting a number of EPC improvement targets.

IPUT Real Estate’s € 300 million green loan with Wells Fargo

At the end of May, the Irish real estate company IPUT Real Estate signed a revolving credit line (RCF) of 300 million euros with Wells Fargo, increased by an existing RCF of 50 million euros. This made RCF Augmented the largest green finance facility in the Irish property market. RCF’s € 200 million green component will be used to finance green projects that meet several criteria based on GLP and tested by several renewable and energy efficient metrics.

Van Oord’s green loan agreements with Rabobank and BNP Paribas

In June, Van Oord, a dredging specialist based in the Netherlands, signed its first green loans with Rabobank and BNP Paribas. The green loans were based on Van Oord’s SEA sustainability program and will fund three new trailing suction hopper dredgers that will each get a green passport and clean ship rating. Van Oord’s SEA program is based on BPL, and one of its advantages is that additional green loans can be added in the future.

The ESG acid test and the green loan

We previously discussed the concept of “ESG acid test”. Once the COVID-19 pandemic has passed, the practice of investing in companies that comply with ESG standards will surely continue to grow. The coronavirus pandemic presents an opportunity for investors with ESG mandates to delve into a company’s track record before making capital allocation decisions. This means that the actions of companies during the COVID-19 crisis can act as an acid test.

Likewise, efforts to rebuild the global economy in the wake of the COVID-19 pandemic will surely lead many borrowers and lenders to focus on rebuilding the economy in a sustainable manner, leading to a “ new green deal. or a “ green recovery ”. We urge all market participants not to fall behind.

-

Things To Remember When Getting Instant Cash Loans For Home Improvement

How do I get a loan for home improvements?

A home improvement loan can be described as an unsecure personal loan that you take out to cover the cost of repairs or upgrades. The lenders offer these loans that can be up to $100,000. The home renovation loan is offered in a lump sum and then you pay it back in monthly installments for a period of between one and 12 years.

Since you do not use your home as collateral in this type of loan and the interest rate is determined by details such as the amount of your credit and earnings. If you are unable to repay the loan for home improvements and you don’t repay it, your credit will suffer.

Home improvement loans in contrast to equity financing

An improvement mortgage can make sense when you don’t have enough equity in the property or do not wish to make use of this as collateral. The equity is the amount that’s between your home’s worth and the amount you owe to your mortgage.

If you have equity you may be able to get lower monthly payments from an equity loan for your home or line credit, However, the lender might require an appraisal prior to approval.

Home equity loan

Equity loans for homeowners can be purchased in lump sums and come with fixed rates of interest, which means that your monthly payments will not change. The loan is repaid in monthly installments over an amount that can be between 15 and 30 years.

Compared to personal loans The home equity loan works similar to personal loans, however, they usually have lower rates and longer repayment times.

The Home Equity line of credit

A HELOC is an open credit line that you can draw upon as you need for renovations and you will only be charged interest for the amount you are able to borrow. It’s a variable-rate loan which is ideal if you do not mind having a fluctuating monthly installment and want to have more borrowing flexibility.

Compare with personal loans The difference is that a HELOC allows you to borrow anytime for around 10 years. It is perfect for projects that require a long time or for unexpected costs. Personal loans are a great option for unexpected expenses. A personal loan offers a one-time cash flow.

How do you obtain a home improvement loan?

For a home improvement loan, first, check the lender’s offers against other options, then check your rates and monthly payments then prepare the documents and apply.

Let’s break them down:

- Compare the various options. Find the top home improvement lenders against one another and against other financing options like credit cards or mortgages based on equity. You’re trying to find the one that is priced at the lowest in the total cost of interest, is affordable for monthly installments, and can be incorporated into your timetable.

- Review your monthly rate and payments. Make sure you set your project’s cost estimate with this method. A lot of online lenders and banks allow borrowers to look at the possibility of personal loan offers before applying however you’ll be asked to specify the amount you’d like to take out. The process is a gentle credit draw.

- Prepare documents. If you’ve decided to apply for a loan collect the documents you’ll need to present to the lender. This could include things like W-2s, payslips as well as proof of address and financial details.

- Apply. You might have applied in person. You may have to make an application on the spot at small banks or credit unions, however larger ones and lenders online typically provide online applications. Most lenders will make an answer within a couple of days after submitting. Then, you can expect to have the money in your account within less than one week.

-

COVER: Sustainable Development as a Driver of Business Transformation – Sustainable Development

[ad_1] Sustainability is a key driver of transformation for businesses as organizations understand the risks associated with a changing environment, according to investment and ... -

Citizens launches Green Deposits for businesses

[ad_1] A bank in Michigan has started a program called Green Deposits to allow business customers to direct their cash reserves to businesses and ... -

Coronavirus pandemic threatens Pennsylvania’s already vulnerable dairy farms

[ad_1] “Maybe that’s what hurts the most – it wasn’t anyone’s fault… Now it’s like, ‘Huh. We really can’t win. – Donny Bartch, a ... -

Kincardine Wind Farm Partnership Announces 7 GW Offer for ScotWind

[ad_1] The duo behind Kincardine, the world’s largest floating wind farm off Aberdeen, have partnered with a joint bid from ScotWind, with energy services ... -

Statkraft sells Andershaw wind farm, retains long-term management role

[ad_1] Andershaw Wind Farm Andershaw Wind Farm Andershaw Wind Farm Andershaw II Wind Farm Andershaw Wind Farm Andershaw Wind Farm – Greencoat UK Wind ... -

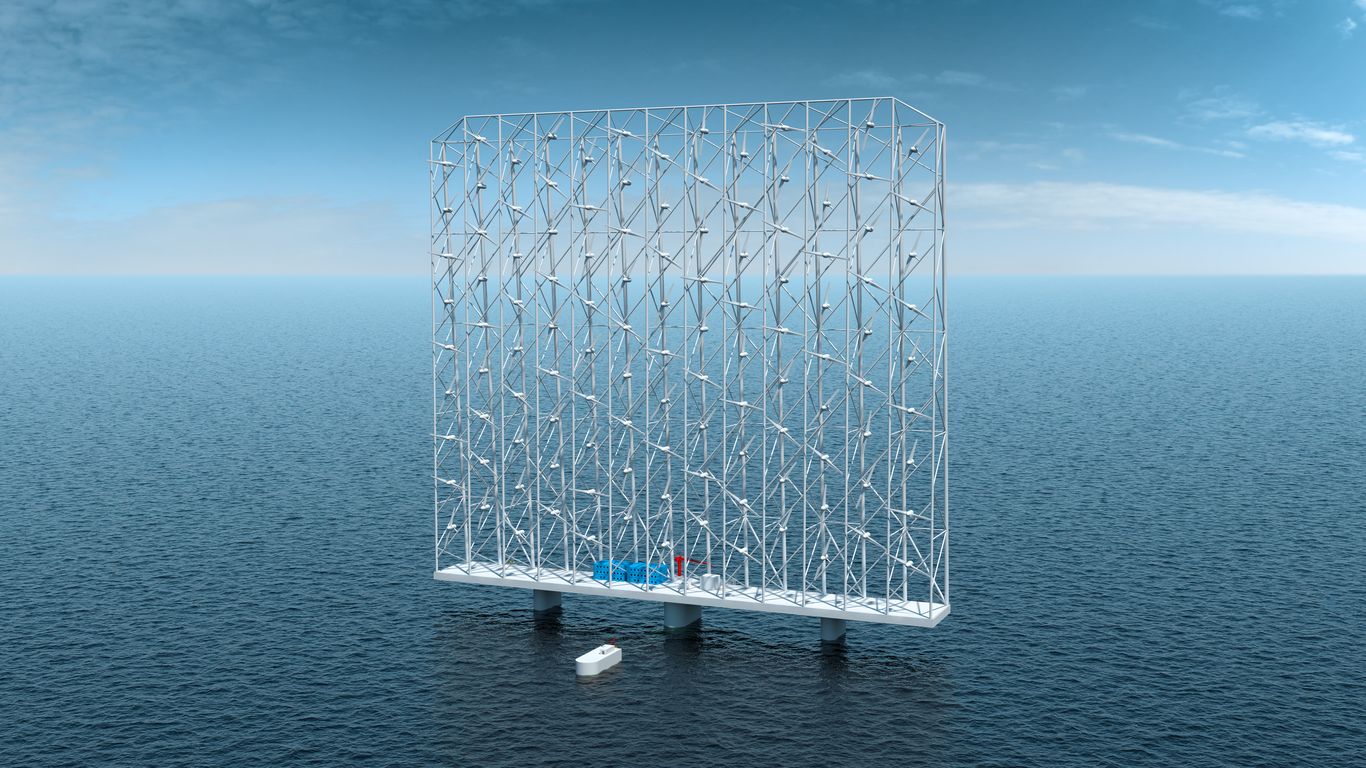

New offshore wind turbine design has many fans

[ad_1] A Norwegian company has come up with a radically different design for offshore wind turbines that could help the world meet its renewable ... -

Surge in offshore winds pushes China beyond 300 GW of installed capacity

China’s offshore wind farms are coming online quickly, resulting in an increase in capacity that has brought China’s cumulative installed wind capacity to over ... -

BP is diversifying, but jobs in refinery and region stay there: “We don’t see anything that will reduce jobs” | Northwest Indiana Business Titles

[ad_1] Ravenfell Manor is an elaborate garden haunt at 715 W Alice St in Kouts. Joseph S. Pete BP plans to introduce electric vehicle ... -

Enlight, Prime reach end near a 372 MW Swedish wind project

[ad_1] May 13 (Renewables Now) – Financial close was achieved on the 372 MW Bjornberget wind project in Sweden following a € 300 million ... -

Iberdrola and GS Energy join forces to promote renewable energies in APAC

[ad_1] Moon Sungwook, Minister of Trade, Industry and Energy of South Korea; Huh Yongsoo, CEO of GS Energy: Xabier Viteri, Director of Renewable Energy ... -

Dominion Energy Continues to Advance Virginia Coast Offshore Wind Project; Finalizes the selection of the main offshore suppliers

[ad_1] RICHMOND, Virginia – November 5, 2021 (Investorideas.com Newswire) Dominion Energy has ramped up efforts to improve a national offshore wind supply chain and ... -

Vestas wins Finland’s 101 MW onshore award – reNews

[ad_1] Vestas has received an order to supply EnVentus turbines to the 102 MW Narpio Norrskogen wind farm, developed by EPV Energy in western ... -

Community Wide Federal Credit Union Review – Forbes Advisor

[ad_1] Editorial Note: We earn a commission on partner links on Forbes Advisor. Commissions do not affect the opinions or ratings of our editors. ... -

Project financing file: Sonnedix raises 172 million euros to refinance its solar projects

[ad_1] Sonnedix Japan, the Japanese subsidiary of the independent global solar power producer Sonnedix, has achieved financial close of 172 million euros (~ 209 ... -

AI explainability specialist Truera closes $ 12 million funding round

[ad_1] Truera Inc., a startup that works to give companies a better insight into how their artificial intelligence models make decisions, today mentionned that ... -

Construction begins on America’s largest offshore wind power plant

[ad_1] Ocean Wind and EEW paved the way for the EEW monopile manufacturing facility at the Port of Paulsboro Marine Terminal in Gloucester County, ... -

Green spring: the markets start their hike towards the weekend …

[ad_1] We see a continuation of yesterday’s rebound in the stock markets as the trading charts flash green ahead of the open. T-bill yields ... -

PPP loan recipients could see tax hikes

[ad_1] (WAOW) – A major shock to businesses in Wisconsin and the country, as recipients of the federal paycheck protection program could be forced ... -

Texas’ 13,000 wind turbines can be winterized, but should they?

[ad_1] Bill Montgomery, UH Energy Fellow ADRIAN TX – APRIL2: Wind power in Texas consists of many wind farms with a total installed nameplate ... -

Energy stocks: Exxon Mobil vote shows radical change in industry

[ad_1] Exxon Mobil (NYSE:XOM) is trading at its highest level in over a year, with a dividend of almost 6%. But institutional investors no ... -

Capitalizing on Australia’s offshore wind potential

A recent report from the Blue Economy Cooperative Research Center, on offshore wind energy in Australia, reveals that Australia has very high quality and ... -

USDA reports show increased acreage, declining grain stocks

[ad_1] By Jennifer WhitlockField editor The United States Department of Agriculture (USDA) yesterday released key reports, including the annual acreage report and the quarterly ... -

Oklahoma Schools Suffer As Big Business Protests Tax Assessments | New

[ad_1] OKLAHOMA CITY – When a wind farm decided to move in, public schools in Minco saw their tax base increase by nearly $ ... -

Aftissat wind farm in Morocco to expand

The Aftissat wind farm in Morocco is in the process of being enlarged. This follows the selection of GE Renewable Energy, a subsidiary of ... -

Entrees: Exploring Delicious Options on the Restaurant Menu

Entrees: Exploring Delicious Options on the Restaurant Menu Imagine walking into a restaurant, hungry and eager to indulge in a delectable dining experience. As ... -

Highlands “in dire straits” as support urged for onshore wind petition

[ad_1] Support is being sought in the Highlands for a petition calling on the Scottish government to give communities more voice in planning decisions ... -

USDA Provides Disaster Assistance to Drought Affected Montana Farmers and Ranchers | New

[ad_1] USDA’s Farm Service Agency (FSA) offers disaster assistance programs and low-interest loans to help with your drought recovery efforts. Programs and loans available ... -

Focus on the new fears of variants

[ad_1] Zoom shares closed up 5.7% and Peloton shares closed up 5.6% on Friday as fears of a new variant of Covid in South ... -

Luke Freeman opens up about Nottingham Forest loan and Sheffield United future

[ad_1] Luke Freeman says he’s not sure what the future holds after a stop-start season at Nottingham Forest. The blades The midfielder is on ... -

2 FTSE 250 renewable energy funds offering BIG dividends

[ad_1] There can’t be many hotter investment spaces right now than the renewable energy sector. Concerns about climate change and the shifting away from ... -

Panel discusses role of agriculture in carbon sequestration | News, Sports, Jobs

[ad_1] Farmfest visitors witnessed a demonstration of a self-contained “Cowbot” mower by UMWCROC and Toro Co. GILFILLAN ESTATE – A panel of farm leaders ... -

Honey Creek Wind officials explain project at meeting in New Washington

[ad_1] NEW WASHINGTON – The wind was not cooperating. As representatives from Apex Clean Energy, Inc. attempted to set up screens and a video ... -

German Encavis buys 74.5 MW wind portfolio in France

The German Encavis Asset Management has acquired five new wind farms in France, with a total capacity of 74.5 MW, to implement the growth ... -

Traditionally red Texas sees boom in green jobs

[ad_1] CBS News is continuing its “Eye on Earth: Our Planet in Peril†series, a week of special coverage on our changing planet, in ... -

ScottishPower and Shell target the potential of floating wind farms

[ad_1] ScottishPower and Shell believe they have three key factors in their favor after filing a joint bid for floating offshore wind farms as ... -

Equinor: RWE and Hydro join forces for offshore wind power in the Norwegian North Sea

[ad_1] Arkona offshore wind farm in the Baltic Sea. (Photo: Eskil Eriksen / Equinor ASA) Together, the partners have strong expertise in all parts ... -

Copenhagen Infrastructure Partners secures $ 1.6 billion in financing for 300 MW offshore wind farm in Taiwan

[ad_1] A consortium of 20 banks signed a $ 1.6 billion (NTD 45 billion) project finance agreement for the 298MW Zhong Neng I Zhong ... -

resident of Haaland Estates celebrates 101st birthday | News, Sports, Jobs

[ad_1] Sue Sitter / PCT Bill Godman enjoys the trappings of his 101st birthday in the dining room at Haaland Estates. When Bill Godman ... -

Scotland doesn’t need more press releases but we need a plan

[ad_1] A report from Robert Gordon University grabbed the headlines with enthusiasm. By 2030, he predicted that “the composition of the offshore energy workforce ... -

Weeds: a year, unfortunately, to remember | News, Sports, Jobs

[ad_1] Fifty years ago the carpenters sang, “Rainy days and Mondays always get me down.” Karen and Richard have never farmed during a drought. ... -

Offshore wind vessel drops 126 tonne rotor sideways

[ad_1] File image courtesy of Vattenfall Posted on October 26, 2021 at 3:29 PM by The maritime executive Last week, a 126-ton wind turbine ... -

3 reasons to invest in renewable energy stocks

[ad_1] Renewable energy stocks have been on fire for the past year, with investors starting to recognize the industry’s growth and maturation in recent ... -

OX2: sells 24 MW wind farm in Poland to infrastructure investor Equitix

Tuesday October 26e, 07.30 CEST – Non-regulatory press release OX2 sold an onshore wind farm with a capacity of 24 MW in the south-east ... -

Coles commits to 100% renewable energy by the end of fiscal year 25

[ad_1] Coles will source 100% of its electricity needs from renewable sources by the end of FY25, after signing this week of the last ... -

Kevin O’Leary explains why bitcoin will beat stocks now

[ad_1] You can’t say “Mr. Merveilleux” didn’t warn you. Shark Tank host Kevin O’Leary was among the first in the investment community to sound ... -

Operators Trust Ukraine’s Importance of Hydrogen for Europe

Four European gas transport operators have agreed to jointly fund research efforts to determine the feasibility of converting existing main gas pipelines to transport ... -

Special Events at Restaurants: A Guide to Memorable Gatherings

When it comes to planning special events, choosing the right venue can make all the difference in creating a memorable gathering. Restaurants have long ... -

Strathrory wind farm offer near Ardross rejected as Ross-shire advisers overturn officials’ recommendation

[ad_1] Councilor Maxine Smith recognized the strength of local sentiment. Dozens of objections from residents and a community council saw a £ 44million wind ... -

SSE Renewables unveils plans for state-of-the-art O&M facility at Port of Arklow – WicklowNews

[ad_1] SSE Renewables has unveiled plans for a state-of-the-art development at Arklow Harbor, County Wicklow, proposed as part of Phase 2 of the Arklow ... -

Wind energy of the future will cost 50% less than expected

[ad_1] Experts predict that the cost of wind power will shatter expectations in the decades to come and become a more affordable source of ... -

Four Georgia counties designated as primary natural disaster areas –

[ad_1] (USDA / FSA / October 27, 2021) – This natural disaster secretariat designation allows the United States Department of Agriculture (USDA) Agricultural service ... -

Scott Twine interview: Newport midfielder on loan, regular playing time and enjoying football ‘more than ever’ | Football news

[ad_1] For Scott Twine, on loan from Newport, loan periods were as much about gaining experience in life as it was about developing in ... -

AEP’s 199 MW Sundance Wind Farm Comes into Operation in Oklahoma

[ad_1] The Sundance Wind Energy Center is part of a larger group that includes two other projects – the 999 MW Traverse Wind Energy ... -

Is it possible to build up credit when you don’t have a job?

[ad_1] Dear Penny, I am a housewife who does not work outside of my home. The only income I have on my own is ... -

Industry update: Energy stocks rebound on Tuesday, oil prices rise

[ad_1] Energy stocks were firmer near Tuesday’s close after rebounding from massive selling on Monday, with the NYSE Energy Sector index rising 1.2% and ... -

Winds of Change: Why Papua New Guinea is Perfectly Positioned for a Wind Energy Revolution

Papua New Guinea is sitting on a world-class wind resource that could enable it to export electricity to the region in a relatively short ... -

PPP loans: millions of business owners need help

[ad_1] The Small Business Administration and the Treasury Department are relaunching the Paycheck Protection Program five months after the end of its first two ... -

Does it make sense to group flights and overland travel together when purchasing travel insurance? – Councilor Forbes

[ad_1] Editorial Note: Forbes Advisor may earn a commission on sales made from partner links on this page, but this does not affect the ... -

Alinta Energy’s offshore wind farm at stake to power Portland aluminum smelter

[ad_1] The Tomago aluminum smelter in New South Wales, the country’s largest consumer of electricity, partially owned by Rio Tinto, also aims to switch ... -

Ampelmann launches plans for U.S. supply ships – ReNews

[ad_1] Ampelmann and C-Job Naval Architects have joined forces to develop an offshore wind power vessel concept for US projects. The vessel with motion ... -

Energy cooperation powers the Horn of Africa

[ad_1] Ethiopians celebrate Adwa’s Victory Day in Ethiopia’s capital Addis Ababa on March 2, 2021. Photo: VCG Energy cooperation under the Belt and Road ... -

Why Skillz Stock Was Up Today

[ad_1] What happened Mobile gaming platform actions Skillz (NYSE: SKLZ) took a big step today – up 6% as of 1:20 p.m. EDT. This ... -

2.7 billion euros of investments needed for onshore wind energy

[ad_1] A new analysis has found that up to € 2.7 billion will need to be invested in providing onshore wind power over the ... -

Construction begins on the first large offshore wind farm in the United States

[ad_1] This photograph, taken on June 13, 2017, shows the Block Island Wind Farm, Rhode Island. David L. Ryan | Boston Globe | Getty ... -

India’s renewable energy industry faces financial challenges

[ad_1] A recent report from a parliamentary group said that India needed Rs. 2.61 trillion to install the balancing capacity to meet its target ... -

Trump signs 5-week PPP extension

[ad_1] President Donald Trump on Saturday signed a bill reopening the Paycheck Protection Program (PPP) application window until August 8. The five-week extension was ... -

Aviation contract for the world’s largest offshore wind project

A global supplier of energy services, Swire Energy Services (SES) ‘s growth in aviation continues with the award of a new contract with Ørsted ... -

NextEra Energy Partners acquires Brookfield Renewable wind portfolio

[ad_1] NextEra Energy Partners (NYSE: NEP) has agreed to acquire a portfolio of US onshore wind assets from Brookfield Renewable Power (NYSE: BEP)(NYSE: BEPC) ... -

Dick Vitale slams Sean Miller in light of recent NCAA allegations

[ad_1] Controversy surrounds Arizona basketball head coach Sean miller. According to a report through Bruce Pascoe in the Arizona Daily Star, school president Robert ... -

Umphrey’s McGee navigates pandemic with live broadcasts, two drive-through concerts

[ad_1] Andrew S. Hughes Umphrey’s McGee guitarist Brendan Bayliss never thought that the sound of 500 car horns honking at the same time could ... -

CSX Board of Directors clears stock split to attract more investors

[ad_1] The board of directors of CSX Company CSX has approved a three-for-one common stock split in the form of a stock dividend. According ... -

Greystone Knowe: plans for Borders 14-turbine wind farm filed

PLANS for a 14 turbine wind farm at the borders have been filed with council. The Greystone Knowe development – about 2.5 km west ... -

MRC grants $ 173 million construction loan for MAG Partners’ West Chelsea rental project – Commercial Observer

[ad_1] Madison Real Estate Capital (MRC) has just concluded a $ 173 million construction loan for the development of 241 28th Street West, learned ... -

How green bottlenecks threaten the clean energy sector

[ad_1] June 12, 2021 ATHE WORLD the economy is waking up, shortages and price spikes are affecting everything from the supply of Taiwanese crisps ... -

Winds of change blow hope in industrial cities and the zero net deal

Loading Mr. Taylor told the Herald and Age On Sunday, the sector “represents a significant opportunity for Australia, with the potential to create thousands ... -

Why the Trade Desk and Other Ad Tech Stocks Are Soaring Today

[ad_1] What happened Ad tech stocks were skyrocketing today on news that Alphabet‘s (NASDAQ: GOOG) (NASDAQ: GOOGL) The Google Chrome web browser is reportedly ... -

Latest updates: WeWork’s losses decrease as demand for office space increases

[ad_1] BBVA, the Spanish bank, has launched a € 2 billion bid for the 50.15% stake in Garanti, Turkey’s largest bank by market capitalization, ... -

Argo Blockchain cryptocurrency miner building in Dickens County

[ad_1] DICKENS COUNTY, Texas (KCBD) – A London, England-based cryptocurrency mining company has chosen Dickens County as the location of its next North American ... -

J&V Energy secures NT $ 6.22 billion loan

[ad_1] RENEWABLE ENERGY: The company said it was working “full steam ahead” on an aquavoltaic project to prepare it to connect to the grid ... -

Beverages Menu: Exploring Refreshing Choices at the Restaurant

Imagine walking into a restaurant on a hot summer day, seeking respite from the scorching sun. As you settle down at your table and ... -

“What’s next” for Siemens Energy?

Everyone in the energy industry knows Siemens Energy. Its technology is responsible for about a sixth of the world’s electricity production, and even more ... -

View Reservation Details: A Guide for Restaurant Reservations

In today’s fast-paced and increasingly digitized world, making restaurant reservations has become a common practice for individuals seeking to secure a table at their ... -

Working in the wind may mean working close to home for the Kansans

[ad_1] When Chance Jacobson graduated from high school, he was faced with a conundrum probably familiar to many young people who grew up on ... -

BisMan Community Food Co-op struggling financially, looking for more community support | Bismarck

[ad_1] Reese said the co-op got through the last fiscal year thanks to a loan from the Paycheck Protection Program – a form of ... -

Renewed interest in offshore wind energy could bring site to central coast

[ad_1] A renewed interest in wind power comes from the Biden administration, again making a possibility of an offshore wind farm on the central ... -

Falck Renewables and BlueFloat Energy develop Italian offshore wind farms

Toni Volpe Falck Renewables and BlueFloat Energy are teaming up for the development of floating offshore wind farms off the coast of Italy and ... -

Mammoet’s equipment to support the Brazilian wind sector

[ad_1] Many wind farms in several countries, including Brazil, have narrow inland roads 6-7m wide. This restricts the use of conventional crawler cranes, as ... -

How cruise lines are using new routes and smaller cruise ships to attract eco-conscious travelers

[ad_1] At Atlas Ocean Voyage’s World Navigator (price starting at $ 5,799 per person), a superyacht-type vessel that launches in July, an entire day ... -

Wind farm sold to Danish company | Hillsboro Star Journal

[ad_1] Wind farm sold to a Danish company The fate of the agreement to buy a building belonging to the city uncertain By PHYLLIS ... -

Start of construction of the largest wind farm

[ad_1] The largest wind farm in New South Wales is expected to start construction at the end of this year after the financial close. ... -

Macquarie led a consortium to develop green hydrogen on Orkney Islands

The hydrogen hub will be built at the existing Flotta terminal, which has been on the island since 1976. Image: GIG de Macquarie. A ... -

Winds of change for the Humber region

Over £ 260million in UK government and private sector investment to develop the next generation of wind turbines as the UK strives to locate ... -

Ongoing training at MMA, UMD, BCC for offshore wind jobs

[ad_1] Rear Admiral Francis X. McDonald Rear Admiral Francis X. McDonald, USMS, is President of the Massachusetts Maritime Academy. The US Department of Energy ... -

5 wind energy actions to get ahead of the renewable energy movement

[ad_1] Major wind power stocks have taken hold this year as investors eagerly await the future of renewables. In fact, renewables are fast becoming ... -

Ørsted completes the acquisition of onshore wind power in Ireland and the United Kingdom

[ad_1] Following our company’s announcement published on April 16, 2021, Ørsted has completed the acquisition of a 100% stake in the onshore wind business ... -

300 jobs announced for Lawton Fort-Sill

[ad_1] Carter Wind Turbines announces Lawton, Oklahoma will be the site of their new wind energy company Carter Wind Turbines (CWT), a subsidiary of ... -

Hurricane Ida doesn’t fully explain why Louisiana lost 30,000 jobs

[ad_1] Preliminary state employment data for September shows a loss of nearly 30,000 seasonally adjusted non-farm jobs from August, and although this is in ... -

Teesworks: Bold claims for new jobs – but do they offer a bright future or empty promises?

[ad_1] On the eve of the election of the mayor of Tees Valley, Local Democracy Reporter STUART ARNOLD visits Dormanstown, Redcar to get the ... -

Offshore wind now responsible for more energy

Hundreds of gigawatts per hour of renewable energy were produced in Denbighshire last year, figures show. Environmental groups have urged the government to expand ... -

Can you reap good dividends without relying on “sinful” stocks?

[ad_1] Like the UK economy, dividends paid by UK companies to shareholders are firmly in recovery mode. Last week, wealth management platform AJ Bell ... -

Glasgow company wins contract for tallest onshore wind turbines in UK

[ad_1] RJ MacLeod has won a contract for the extension of a South Lanarkshire wind farm that will house the UK’s first 200-meter-high onshore ... -

“I feel intimidated by all of this” – Paul Apap Bologna

[ad_1] An attempt to toast Paul Apap Bologna on the Electrogas deal at the Public Accounts Committee again yielded very few responses, as the ... -

The surf champion showing how the wild weather of Wales can be used to fight climate change

An Abersoch adaptive surf champion is raising awareness of how weather could help generate renewable energy in a bid to tackle climate change. As ... -

Restaurant Reviews: Unveiling the Hidden Gems and Avoiding the Blunders

Restaurant Reviews: Unveiling the Hidden Gems and Avoiding the Blunders In today’s bustling culinary landscape, finding a restaurant that offers exceptional dining experiences can ... -

Letters from readers, June 13, 2021 | Notice

[ad_1] More than ever, we need to know who we are electing. There is no more room for empty promises from rehashed politicians. A ... -

5 reasons why I finally decided to buy Bitcoin and Ethereum

[ad_1] the S&P 500 the index hovers around a record level and the Dow Jones Industrial Average is up 12% over the year. Impressive ... -

The convincing arguments for joining AMC Stock Bulls

[ad_1] True to its name, AMC Entertainment (NYSE:AMC) provided all kinds of entertainment for speculators. He stands beside GameStop (NYSE:GME) as a mainstay of ... -

State Council approves tax break for North Bend Wind

[ad_1] PIERRE, SD (KELO) – A proposed wind project in central South Dakota received approval for a state sales tax rebate, months before state ... -

Montenegro’s EPCG to take full ownership of Gvozd wind farm project

[ad_1] PODGORICA (Montenegro), November 3 (SeeNews) – Elektroprivreda Crne Gore (EPCG), Montenegro’s predominantly state-owned electricity company [BEL:EPCG] said it had signed an agreement with ...

/cloudfront-us-east-1.images.arcpublishing.com/gray/SNV7PRR5KBENFPAZUXF3CJ7DTU.JPG)